100k deposit how much can i borrow

Find out how much deposit you may need when you take out a HomeStart loan. How much can you borrow from your 401k.

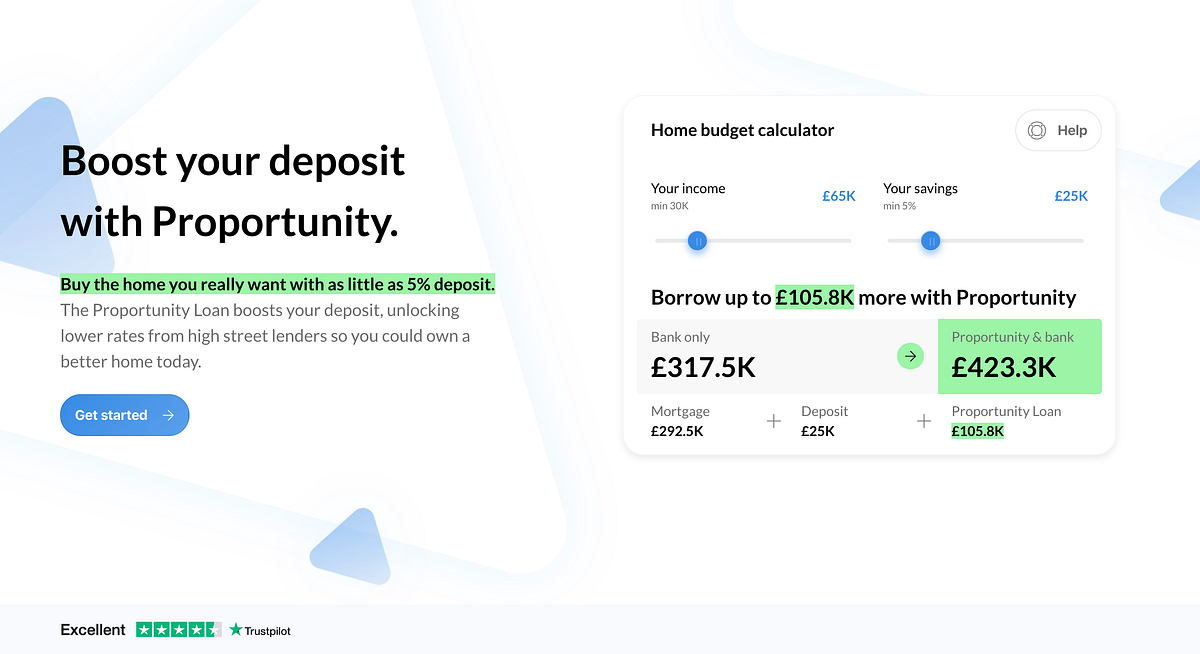

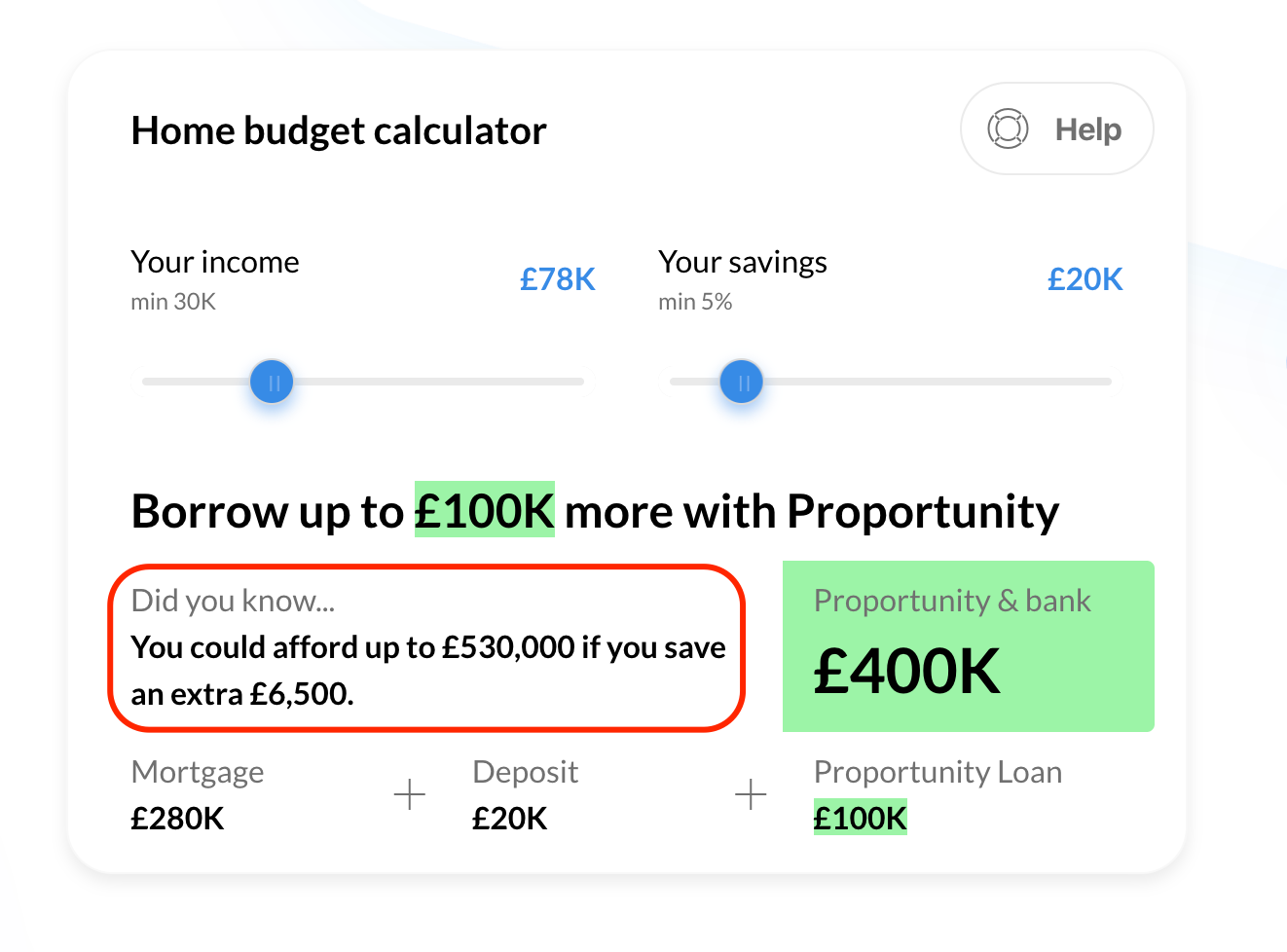

Product Marketing Case Study Proportunity S Homepage By Andrei țiț Product Mk Medium

Understanding the value of the home is important if you ever want to sell refinance or borrow against your homes value.

. The credit line option. By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage.

They have two options. With Fleximize you can apply to borrow between 5000 and 500000 depending on your monthly revenue. We can lend up to a maximum of two months revenue.

In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. Wealthfront offers a similar product a Portfolio Line of Credit. This is different to a standard mortgage the amount you can borrow is assessed against the value of a property you can offer as security rather than your earnings.

So its good to know that if you find a lender prepared to accept a 10 deposit you can still buy into a good investment location for a relatively modest price provided you do your research The cheapest median price on the list is 590000 potentially making it possible for an investor to buy a property with a deposit of just 59000. Property price This field is required. You can see what your rate will be and how much you can get.

The SOFR rate is the Secured Overnight Financing Rate which you can see on the Federal Reserve Bank of New York website. They can either borrow from banks loans or they can issue bonds. Some plans also have a minimum loan amount that can be requested.

If you have just 25000 in assets vs. How to Invest 500K. As leaders in the mortgage industry we have a variety of loans available and mortgage experts.

She will need about 30000 as a deposit. Receiving pre-approval is a conditional agreement from a lender to grant. Its a good indicator of whether you satisfy minimum requirements to qualify for a mortgage.

You can apply to top this up following a few successful repayments as many of our customers do. Wealthfront Portfolio Line of Credit. Schwabs higher 100000 requirement you can access this product and borrow against up to.

This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. Refinance or a home equity loan your best option is to get a free quote. For example your expenses credit history any debt.

Reverse Mortgage Line of Credit. 100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit. The lowest car loan rate of 335 pa comparison rate 495 pa can be found with Car Claritys Car Loan car loan.

Some examples are savings accounts certificates of deposit CDs money market and federal insurance. This provides a rough estimate of how much you can borrow for a loan. So if you generate 50000 in a typical month you could borrow up to 100000 initially.

Borrow Business Loans Lines Instacap Loan - up to 100k Agricultural Loans. Releasing 100K in equity from a holiday home. How to Invest 1M.

Meanwhile pre-approval is a formal assessment of your credit background. How to Invest 200K. First home buyer Your purchase.

My house is worth around 450000. You can contact your Local Banking Center or Loan Operations Customer Service at 800-905-9043 extension 11350. Building or simply need a bigger place to call home we can help.

How to Invest 100K. Your salary is certainly an important element in assessing how much you can borrow but so are a number of other factors. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them.

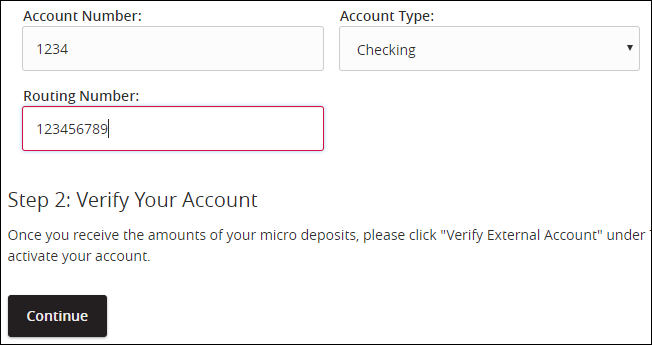

We currently only accept payments from a WesBanco Deposit Account over the phone. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Our experts will find the mortgage thats right for you.

So if your home is worth 250000 and you owe 150000 on your mortgage you. How much of my equity can I borrow. 100k deposit 500k assumed price 02 x100 for a percentage 20 deposit.

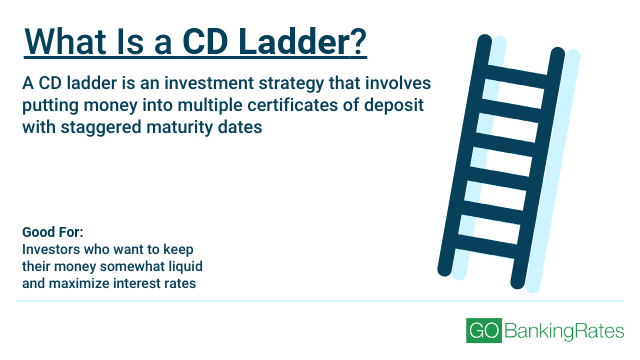

Certificates of Deposit CD. Learn as much as you can about real estate. How much can I borrow.

Some will go up to 90 or even 95 but an 80 limit is far more common. However the actual maximum amount you can borrow from your 401k may be less depending on what your plan allows. Most lenders will lend you up to 80 of your propertys value.

/Deposit10000-573c393de8f54f1fbb760538b5506c3d.jpeg)

What Happens If You Deposit More Than 10 000 In The Bank

I Lenda V L Won The December Lotto Jackpot 4 3 13 222 111 Money Flows Effortlessly With Abundance To Me Pound Money Money Stacks Money Cash

The Greatest Wisdom From The Pages Of Classic Children S Books Chapter Books Kids Story Books Classic Childrens Books

What Is A Cd Certificate Of Deposit And How Do They Work Gobankingrates

Can Bridging Loans Be Used To Buy Property At Auction Buying Property Loan Bridge Loan

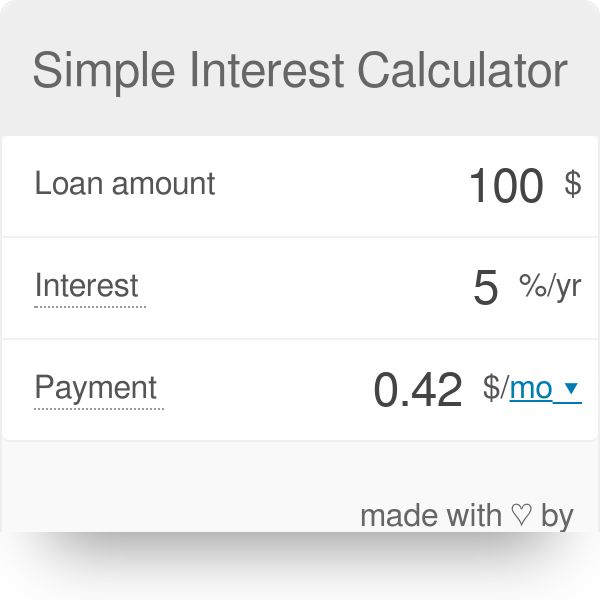

Simple Interest Calculator Defintion Formula

Product Marketing Case Study Proportunity S Homepage By Andrei țiț Product Mk Medium

Ipad Note Inspiration Economics Notes Learn Economics Notes Inspiration

External Transfer In Online Banking Greenstate Credit Union

Best Cd Rates For August 2022 Up To 4 60 With Liquidity

Pin On Bridging Loans

Earnest Money What To Know And How Much Is Enough

Deposit Calculator How Much Do I Need To Buy A House Or Home Loan

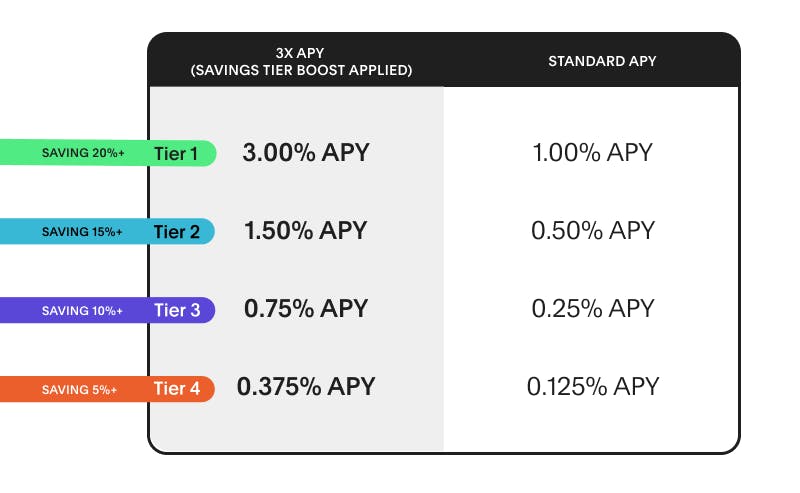

Qualifying For Up To 3 00 Apy On Your Hatch Bank Deposit Account Hmbradley

![]()

Pin On Bridging Loans

Best Cd Rates For August 2022 Up To 4 60 With Liquidity

Certificates Of Deposit Anb Bank