How much money can j borrow for a mortgage

When you want to borrow money you visit with a lendereither online or in-personand apply for a loan. 365 days per year.

What Is A Reverse Mortgage Money Money

Lets say you own a home with a value of 330000.

. Earlier this year she had to borrow money to file for bankruptcy. Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. My wife want to borrow money 8 LAKHS interest free form her mother mother in law and from me through cheque to settle the amount to is family members for releasing one part of their legal heirs property vacant plot.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Your emergency money can go toward paying your mortgage if. If annual inflation subsequently rises to 10 the annual decline in your inflation-adjusted loan balance will outweigh your interest costs.

In 1980 for example a movie ticket cost on average 289. She is also a tax payer. The payment typically represents only a percentage of the full.

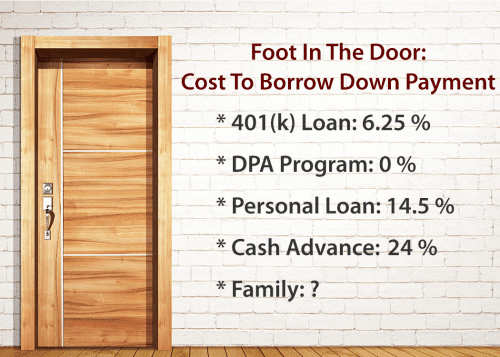

How Does Inflation Work. Retirement account loans Youre allowed to borrow up to 50 of your 401k balance with a cap of 50000 without getting penalized by the IRS. A mortgage must go toward the purchase of the listed property and an auto loan must go toward the specified car but a line of credit can be used at the discretion of the borrower.

Most homeowners make mortgage payments on a monthly basis or 12 payments each year. Technically speaking you can start dropshipping for less than 100. How much house can I afford.

As a company we try as much as possible to ensure all orders are plagiarism free. Your bank or credit union is a good place to start. You can also work with specialized lenders such as mortgage brokers and peer-to-peer lending services.

A home equity loan HEL allows you to borrow against the equity youve built up in your home. With the right combination of free trials and starter plans and a willingness to look the other way and hope for the best when it comes to the quality of your products a little investing is. Home equity loan.

Right now rich people can write off mortgage interest on their second home and expenses related to being a landlord or I. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment. I heard the same walls-closing-in anxiety from millennials around the country and across the income scale from cashiers in Detroit to nurses in Seattle.

The modern day transnational scam can be traced back to Germany in 1922. Mortgage brokers connect borrowers with lenders. Victims can be enticed to borrow or embezzle money to pay the advance fees believing that they will shortly be paid a much.

That said it may still make sense to pay the full 20 of the homes purchase price if possible. Please advise me how to borrow money through demand promissory note to avoid any income tax problem. It will allow you to pay off the mortgage in a much shorter time frame and build home equity sooner.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Banks brokerages mortgage companies and insurance companies earnings often increaseas interest rates move higherbecause they can charge more for lending. A down payment is a type of payment made in cash during the onset of the purchase of an expensive good or service.

Debt is an amount of money borrowed by one party from another. Lets answer a popular dropshipping FAQ. The idea of a 20 down payment can make homeownership feel unrealistic but the good news is that very few lenders still require 20 at closing.

Before you decide you should weigh the pros and cons of making a large down payment to see what is not only feasible for. Had to sell belongings and mortgage a house or by comparing the salary scale and living conditions in their country to those in the West. To calculate the percentage ROI for a cash purchase take.

For new home buyers. While your lender is willing to loan you a substantial amount of money that doesnt mean you have to borrow the entire amount if it would put you under significant financial strain. For example the 2836 rule may help you decide how much to spend on a home.

Say you borrow 1000 at a 5 annual rate of interest. Inflation occurs when prices rise across the economy decreasing the purchasing power of your money. Bonds Interest rates also affect.

You have 220000 left to pay on your 30-year mortgage so you have 110000 worth of equity in your home. Youll make 26 payments per year if you split your monthly payment into two equal amounts instead and you send your payment every two weeks. Debt is used by many corporations and individuals as a method of making large purchases that they could not afford under normal.

After the period is over the ownership of the house is transferred to. They are typically paid 1 to 2 of the loan amount by either the borrower or the lender. Using a percentage of your income can help determine how much house you can afford.

A good rule of thumb is to sock away 3 6 months worth of expenses. These loans often have low interest rates. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

How much does it cost to start a dropshipping business. All our papers are written from. Feel safe whenever you are placing an order with us.

However keep in mind youd be repaying that loan with money that has been taxed while the funds invested in a 401k are pre-tax dollars. Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage. Your equity is calculated by assessing your homes value and subtracting.

The loan is secured on the borrowers property through a process. Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday. How to Calculate a Down Payment Amount.

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a.

Pin On Finance

Apply Online Today Get Approved Car Title Loans Only With Canadian Title Store We Provide Loans In Calgary Alberta And T Edmonton Alberta Alberta Car Title

Credit Score Chart And How This Helps You Get The Lowest Interest Credit Score Chart What Is Credit Score Credit Score

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Payday Installment Loan Singapore Money Lender Installment Loans Loan Consolidation

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Get Knowledgeable About Cost And Working Of A Loan Before Borrowing Scoopify Lotto Gewinnen Lotto Spielen Lotto

How Much House Can I Afford Calculator Money

Pin On Home Buying Tips And Tricks

Never Borrow Money For These 5 Buys Borrow Money The Borrowers Pay Off Mortgage Early

Mortgage Calculator How Much Can I Borrow Nerdwallet

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Mortgage Calculator How Much Can I Borrow Nerdwallet

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet